The Nainital Bank Recruitment 2025 notification has created significant excitement among banking aspirants across North India. With 175 vacancies spanning multiple positions from Customer Service Associates to Specialist Officers, this represents one of the most comprehensive recruitment drives by the century-old banking institution. If you’re preparing for banking exams or seeking stable career opportunities in the financial sector, this guide provides everything you need to know about the Nainital Bank Recruitment 2025.

According to Indeed’s job market analysis, banking sector employment continues showing robust growth, with private sector banks offering competitive packages and excellent career progression. The Nainital Bank Recruitment 2025 aligns perfectly with this trend, offering positions across five North Indian states with attractive compensation structures.

Understanding Nainital Bank and Its Recruitment Process

The Nainital Bank Limited stands as a unique institution in India’s banking landscape. Established in 1922 by Bharat Ratna Late Pt. Govind Ballabh Pant, this scheduled commercial bank operates with 98.62% shareholding from Bank of Baroda, providing it with strong financial backing while maintaining its regional identity.

The bank’s network of 176 branches spread across Uttarakhand, Uttar Pradesh, Delhi, Haryana, and Rajasthan serves diverse customer segments from retail banking to agricultural finance. This expansion directly influences the Nainital Bank Recruitment 2025, as the institution seeks talented professionals to support its growth trajectory.

Understanding the bank’s operational model helps candidates appreciate what working at Nainital Bank entails. Unlike large nationalized banks with standardized processes, Nainital Bank combines the stability of traditional banking with the agility of private sector institutions. This creates a work environment that values both innovation and established banking principles.

The recruitment process follows Reserve Bank of India guidelines for banking sector hiring, ensuring transparency and fairness. The bank employs a two-stage selection mechanism—written examination and personal interview—allowing comprehensive candidate assessment beyond just academic qualifications.

Complete Vacancy Breakdown for Nainital Bank Recruitment 2025

The Nainital Bank Recruitment 2025 encompasses diverse positions catering to different educational backgrounds and skill sets. Understanding each position’s requirements helps candidates identify suitable opportunities matching their qualifications and career aspirations.

| Position Name | No. of Vacancies | Grade/Scale | Age Limit (Min-Max) |

|---|---|---|---|

| Customer Service Associate (CSA) | 71 | Clerical | 21-32 years |

| Probationary Officers (Generalist) | 40 | Scale-I | 21-32 years |

| Risk Officer | 3 | Scale-I | 21-32 years |

| Chartered Accountant (CA) | 3 | Scale-I | 21-32 years |

| Information Technology Officer | 15 | Scale-I | 21-32 years |

| Law Officer | 2 | Scale-I | 21-32 years |

| Credit Officer | 10 | Scale-I | 21-32 years |

| Agricultural Field Officer | 10 | Scale-I | 21-32 years |

| HR Officer | 4 | Scale-I | 21-32 years |

| Manager – IT | 15 | Scale-II | 25-35 years |

| Manager – Risk | 2 | Scale-II | 25-35 years |

| Manager – CA | 5 | Scale-II | 25-40 years |

| Manager – Law | 2 | Scale-II | 25-40 years |

| Manager – Security Officer | 3 | Scale-II | Up to 45 years |

The Customer Service Associate positions constitute the largest segment, offering 71 opportunities for candidates beginning their banking careers. These positions handle frontline customer interactions, account operations, and branch banking services—essential functions providing comprehensive exposure to banking operations.

Probationary Officer positions represent the traditional entry point into banking management. The 40 generalist PO vacancies offer rotation across various banking departments during the probationary period, building well-rounded banking professionals who understand institutional operations holistically.

Specialist Officer positions cater to professionals with technical qualifications in fields like Information Technology, Risk Management, Law, and Agriculture. According to LinkedIn’s job market insights, specialist roles in banking are experiencing increased demand as financial institutions embrace digital transformation and regulatory complexity.

For comprehensive details about each position’s specific requirements, candidates should review the official recruitment notification published by Nainital Bank.

Educational Qualifications and Eligibility Criteria

The Nainital Bank Recruitment 2025 maintains clear educational standards ensuring candidates possess necessary foundational knowledge for banking roles. Understanding these requirements helps aspirants determine their eligibility before investing time in application preparation.

Customer Service Associate Requirements

CSA positions require graduation or post-graduation with minimum 50% marks in any recognized stream. This broad eligibility opens opportunities for candidates from arts, science, and commerce backgrounds. Proficiency in computer skills and knowledge of Hindi and English languages receive preference, reflecting the multilingual customer base Nainital Bank serves.

The relatively accessible educational requirements for CSA positions align with industry standards for clerical banking positions, making these roles excellent stepping stones for individuals beginning banking careers without specialized degrees.

Probationary Officer Qualifications

Probationary Officer positions similarly require graduation or post-graduation with minimum 50% marks, but emphasize candidates’ aptitude for management responsibilities. The generalist nature of PO roles means candidates from any academic discipline can apply, provided they demonstrate strong analytical abilities and communication skills during selection.

Specialist Officer Credentials

Specialist positions demand specific educational backgrounds relevant to their functional areas:

Information Technology Officers must hold 4-year engineering degrees in Computer Science, Information Technology, or Electronics, or post-graduate degrees in related fields. Graduates with DOEACC ‘B’ level certification also qualify. Minimum 60% marks are mandatory, reflecting the technical precision required in banking technology roles.

Risk Officers need full-time MBA degrees specializing in Finance or Master’s degrees in Mathematics, Statistics, or Econometrics with minimum 60% marks. Certifications in Risk Management from IIBF, NIBM, or GARP receive preference, as these demonstrate specialized knowledge in banking risk assessment.

Chartered Accountants must be qualified CAs from the Institute of Chartered Accountants of India (ICAI). No additional experience is required for Scale-I positions, though JAIIB/CAIIB certifications provide advantages for Scale-II roles.

Law Officers require Bachelor’s degrees in Law (LLB) with minimum 50% marks and must be enrolled as advocates with Bar Councils. Master’s degrees in law receive preference for senior positions.

Credit Officers need graduation plus full-time two-year MBA/MMS/PGDM/PGDBM with Finance specialization and minimum 60% marks. This combination ensures officers possess both foundational knowledge and specialized financial analysis capabilities.

Agricultural Field Officers must hold 4-year degrees in Agriculture, Horticulture, Animal Husbandry, Veterinary Science, or related agricultural sciences with minimum 50% marks. This reflects Nainital Bank’s commitment to rural and agricultural banking sectors.

HR Officers require graduation plus two-year full-time post-graduate degrees or diplomas in Personnel Management, Industrial Relations, HR, or Social Work with minimum 50% marks.

For Scale-II Manager positions, candidates must possess the same educational qualifications as Scale-I but additionally demonstrate minimum two years of relevant work experience in banking or financial institutions. This experience requirement ensures managers bring practical knowledge to leadership roles.

Visit Today Tamil Job’s comprehensive guide for detailed position-wise qualification breakdowns and eligibility clarifications.

Age Limit and Relaxation Provisions

Age eligibility for Nainital Bank Recruitment 2025 follows structured guidelines ensuring candidates possess appropriate career stages for different positions. As of November 30, 2025, candidates must fall within specified age brackets.

Customer Service Associates and Scale-I Officers (including all specialist positions at this level) must be between 21 and 32 years old. This range accommodates fresh graduates (minimum 21) while allowing experienced professionals up to 32 years to apply, recognizing that many candidates pursue banking careers after exploring other sectors initially.

Scale-II Manager positions for IT, Risk, CA, and Law have minimum ages of 25 years, reflecting the experience requirements for these roles. Maximum ages vary: IT and Risk Managers up to 35 years, while CA and Law Managers can apply until 40 years, acknowledging longer qualification timelines for professional credentials.

Manager – Security Officer positions uniquely allow candidates up to 45 years, recognizing that this role specifically seeks individuals with substantial military or paramilitary experience, typically accumulated over longer career spans.

Age relaxation provisions follow Government of India norms for reserved categories including SC/ST/OBC/PwD candidates, though specific relaxation years should be confirmed through official notifications. According to central government employment guidelines, standard relaxations typically include 5 years for SC/ST, 3 years for OBC, and 10 years for PwD candidates.

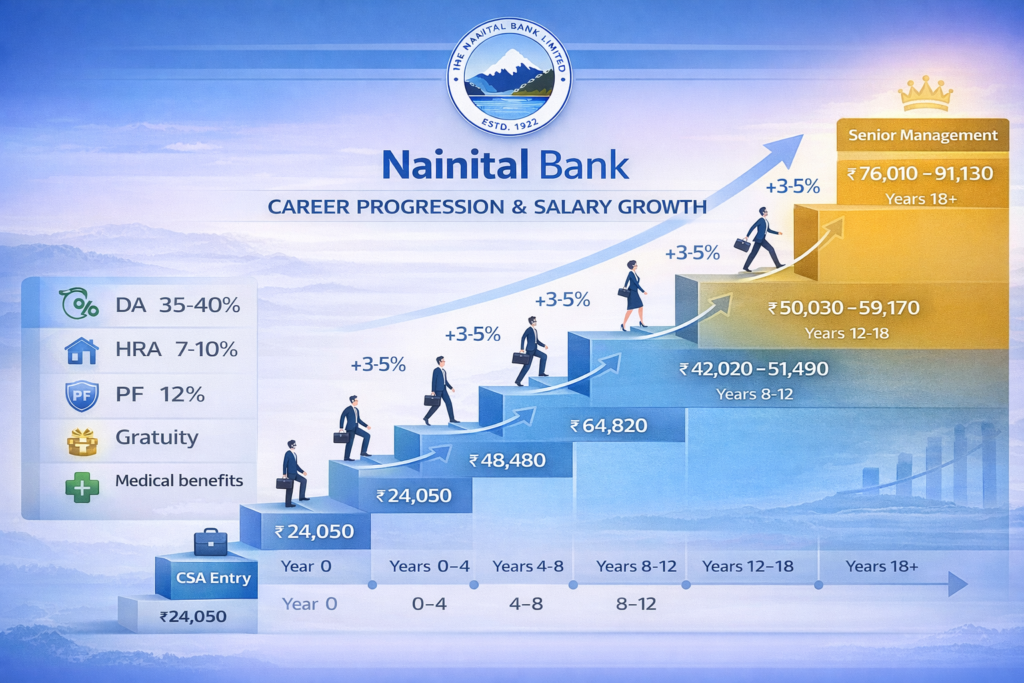

Salary Structure and Career Benefits

Understanding compensation structures helps candidates evaluate Nainital Bank Recruitment 2025 opportunities against alternative career options. The bank offers competitive pay scales aligned with industry standards while providing comprehensive benefits supporting long-term financial security.

| Position Category | Starting Basic Pay | Maximum Basic Pay | Grade |

|---|---|---|---|

| Customer Service Associate | ₹24,050 | ₹64,480 | Clerical |

| Officers Scale-I | ₹48,480 | ₹85,920 | Officer |

| Managers Scale-II | ₹64,820 | ₹93,960 | Manager |

These basic pay figures form the foundation of total compensation, with actual take-home significantly higher when including allowances. According to PayScale’s banking salary data, private sector banks like Nainital Bank typically offer 30-40% additional compensation through various allowances.

Dearness Allowance (DA) adjusts periodically based on inflation indices, protecting purchasing power against rising costs. As of 2025, DA for banking sector employees averages 35-40% of basic pay, substantially increasing monthly earnings.

House Rent Allowance (HRA) varies by posting location, with higher rates in metropolitan areas. HRA typically ranges from 7-9% of basic pay in smaller towns to 9-10% in major cities, partially offsetting housing costs.

Other allowances include:

- City Compensatory Allowance (CCA) for metro postings

- Transport Allowance

- Medical Reimbursement

- Leave Travel Allowance (LTA)

- Children’s Education Allowance

Provident Fund contributions follow statutory requirements, with both employer and employee contributing 12% of basic salary plus DA, building substantial retirement corpus. Conservative calculations suggest a 25-year banking career accumulates provident fund balances exceeding ₹50 lakhs for officer-level employees.

Gratuity becomes payable after five years of continuous service, calculated at 15 days’ salary for each completed year. This provides significant financial cushion during retirement or employment transitions.

Pension benefits, if applicable under bank schemes, provide lifetime income security post-retirement. While new employees typically join contributory pension schemes rather than defined benefit plans, these still offer structured retirement planning.

Performance incentives and annual increments reward meritorious service, creating upward salary mobility without necessarily requiring promotions. Banking sector employees typically receive 3-5% annual increments, with exceptional performers earning higher percentages.

Career progression significantly impacts lifetime earnings. Officers joining at Scale-I can reasonably expect reaching Scale-III or Scale-IV positions (₹42,020-51,490 to ₹50,030-59,170 respectively) within 10-15 years, effectively doubling compensation. Exceptional performers may reach senior management scales exceeding ₹76,010-91,130.

Application Process and Important Dates

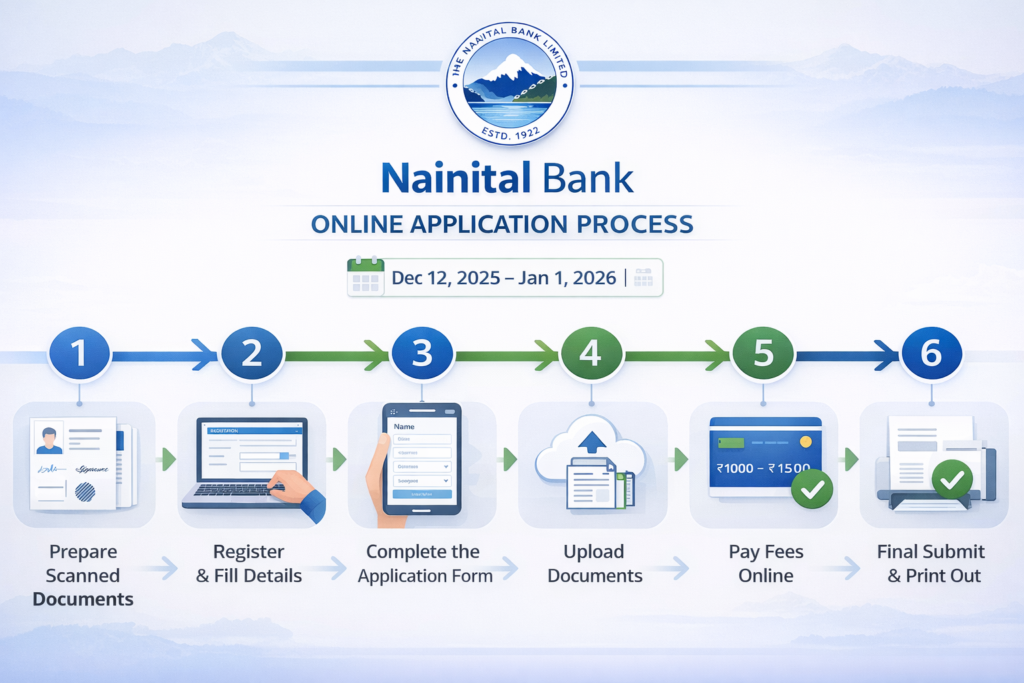

Successfully navigating the Nainital Bank Recruitment 2025 application process requires understanding procedural steps and adhering to timelines. The bank conducts recruitment entirely online, eliminating geographical barriers while maintaining process integrity.

Timeline for Nainital Bank Recruitment 2025

| Event | Date |

|---|---|

| Notification Publication | December 11, 2025 |

| Online Application Opens | December 12, 2025 |

| Online Application Closes | January 1, 2026 |

| Application Fee Payment Last Date | January 1, 2026 |

| Admit Card Download | To be announced |

| Online Examination (Tentative) | January 18, 2026 |

| Result Declaration | To be announced |

| Interview Schedule | To be announced |

Candidates should note that these dates, particularly the examination date, are tentative and subject to official confirmation. Regularly checking the official Nainital Bank website ensures staying updated on any schedule modifications.

Step-by-Step Application Procedure

Step 1: Document Preparation

Before beginning online registration, candidates must prepare digital copies of required documents meeting specified technical standards:

- Recent passport-size photograph (4.5cm × 3.5cm) in JPG/JPEG format, 200×230 pixels, 20-50 KB file size

- Signature captured with black ink, 140×60 pixels, 10-20 KB

- Left thumb impression on white paper with black/blue ink, 240×240 pixels, 20-50 KB

- Handwritten declaration in English stating application accuracy, 800×400 pixels, 50-100 KB

According to digital document standards, maintaining specified resolutions ensures proper reproduction during examination and verification processes.

Step 2: Online Registration

Visit www.nainitalbank.bank.in and navigate to the Career section. Click “Current Openings” under the Recruitment tab, then select “APPLY ONLINE.” Choose “Click here for New Registration” and enter name, contact details, and email ID. The system generates a Provisional Registration Number and Password, sent via email and SMS.

Step 3: Application Form Completion

Log in using registration credentials and systematically complete all application sections. Use the “SAVE AND NEXT” feature to preserve information while working through multiple sittings if needed. Carefully verify all entries before proceeding, as modifications become impossible after final submission.

Personal details, educational qualifications, work experience (if applicable), and exam center preferences require accurate input. Mismatches between application information and supporting documents cause disqualification during verification.

Step 4: Document Upload

Upload prepared photograph, signature, thumb impression, and declaration following technical specifications exactly. Preview uploaded images to confirm clarity—blurred or unclear images lead to application rejection. The system validates file sizes and formats, displaying error messages if specifications aren’t met.

Step 5: Fee Payment

Application fees differ by position category:

- Customer Service Associate: ₹1,000 (including GST)

- Scale-I and Scale-II Officers: ₹1,500 (including GST)

Payment accepts Debit Cards (RuPay/Visa/MasterCard/Maestro), Credit Cards, Internet Banking, UPI, and Mobile Wallets. After submitting payment information, wait for server confirmation without pressing back or refresh buttons to avoid double charges. Successful transactions generate e-Receipts, which candidates must download and preserve.

Bank transaction charges are candidate-borne. According to digital payment regulations, most payment gateways charge 0.5-1% for debit cards and 1.5-2% for credit cards.

Step 6: Final Submission

Review the complete application using the Preview tab, verifying all information accuracy. After confirmation, click “COMPLETE REGISTRATION.” This action finalizes the application—no subsequent modifications are possible. Print the submitted application form for personal records.

Candidates can apply for both Customer Service Associate and one Officer position (either Scale-I or Scale-II, not both) by submitting separate applications with individual fees for each. Multiple applications for the same position retain only the latest valid submission, with fees for duplicate registrations forfeited.

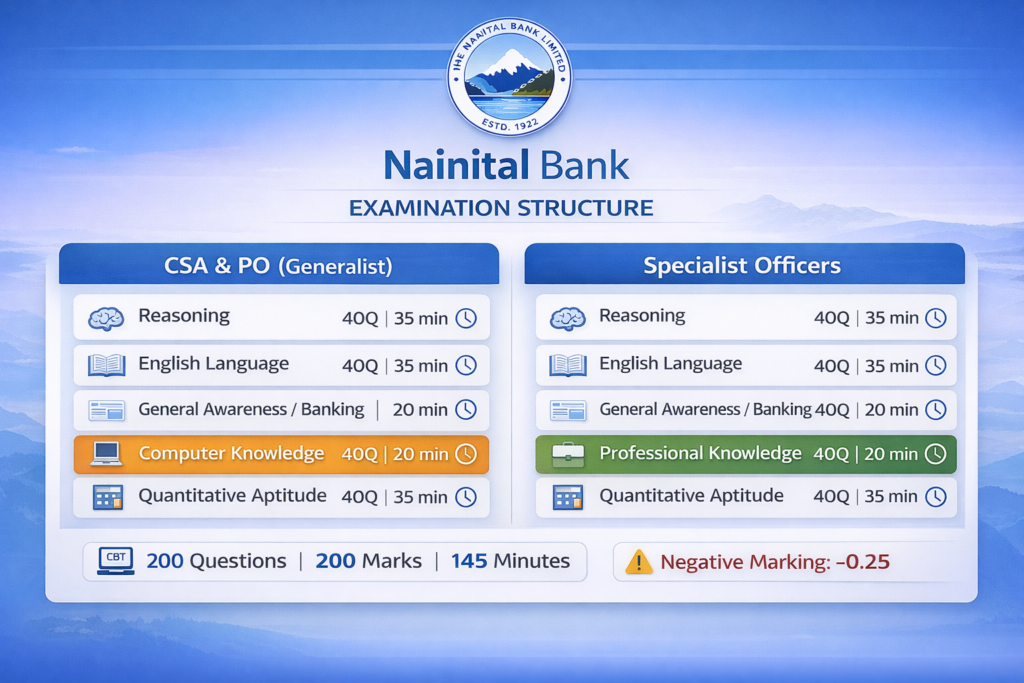

Examination Pattern and Syllabus

The Nainital Bank Recruitment 2025 employs computer-based testing to assess candidates across multiple competency areas. Understanding examination structure helps aspirants prepare strategically, allocating study time proportionate to each section’s weightage and difficulty.

For Customer Service Associate and Probationary Officers (Generalist)

| Test Name | Questions | Marks | Duration | Medium |

|---|---|---|---|---|

| Reasoning | 40 | 40 | 35 minutes | English |

| English Language | 40 | 40 | 35 minutes | English |

| General Awareness (Banking) | 40 | 40 | 20 minutes | English |

| Computer Knowledge | 40 | 40 | 20 minutes | English |

| Quantitative Aptitude | 40 | 40 | 35 minutes | English |

| Total | 200 | 200 | 145 minutes | – |

For Specialist Officers (All Categories)

| Test Name | Questions | Marks | Duration | Medium |

|---|---|---|---|---|

| Reasoning | 40 | 40 | 35 minutes | English |

| English Language | 40 | 40 | 35 minutes | English |

| General Awareness (Banking) | 40 | 40 | 20 minutes | English |

| Professional Knowledge | 40 | 40 | 20 minutes | English |

| Quantitative Aptitude | 40 | 40 | 35 minutes | English |

| Total | 200 | 200 | 145 minutes | – |

The examination employs negative marking with 0.25 marks deducted for each incorrect answer, making blind guessing counterproductive. Each question offers five answer options, requiring careful evaluation of alternatives.

Reasoning sections test logical thinking, pattern recognition, and analytical abilities through puzzles, seating arrangements, syllogisms, coding-decoding, blood relations, and direction sense questions. According to cognitive assessment research, reasoning tests effectively predict job performance in analytical roles like banking.

English Language evaluates reading comprehension, grammar, vocabulary, and verbal ability. Questions include error detection, sentence improvement, fill-in-the-blanks, synonyms, antonyms, idioms, and passages requiring inference. Banking communication demands precision, making English proficiency essential.

General Awareness focuses on banking sector knowledge including recent developments, economic policies, financial inclusion initiatives, banking terminology, and current affairs from the past six months. Questions also cover static general knowledge about India’s geography, history, and governance structures.

Computer Knowledge examines understanding of basic computer concepts, Microsoft Office applications, internet usage, email, networking fundamentals, cybersecurity awareness, and banking technology terms like NEFT, RTGS, mobile banking, and core banking solutions.

Quantitative Aptitude tests mathematical abilities through arithmetic (percentages, ratios, averages, profit-loss, simple and compound interest), algebra, data interpretation (tables, graphs, charts), and number systems. Banking roles frequently involve numerical analysis, making quantitative skills crucial.

Professional Knowledge (for Specialist Officers) assesses domain-specific expertise relevant to each position. IT Officers face questions about programming, databases, networking, and software engineering. Risk Officers encounter risk management frameworks, Basel norms, and financial risk assessment. Similar specialized content applies to CA, Law, Credit, Agriculture, and HR officer examinations.

Examination Centers and Logistics

The Nainital Bank Recruitment 2025 conducts examinations across 11 strategically located centers ensuring geographic accessibility for candidates across North India.

Available examination centers include:

- Haldwani, District Nainital (Uttarakhand)

- Dehradun (Uttarakhand)

- Roorkee (Uttarakhand)

- Bareilly (Uttar Pradesh)

- Meerut (Uttar Pradesh)

- Moradabad (Uttar Pradesh)

- Lucknow (Uttar Pradesh)

- Jaipur (Rajasthan)

- Delhi/NCR

- Ambala (Haryana)

- Kanpur (Uttar Pradesh)

Candidates select three center preferences during application based on convenience and proximity. The bank allots examination venues within chosen cities closer to examination dates.

However, the bank reserves rights to cancel centers with insufficient candidate registration or add centers based on response volume. Candidates may be allotted alternative centers if their chosen locations become unavailable or reach capacity limits. No requests for center changes after initial selection receive consideration.

According to test administration standards, distributing examination centers across wide geographic areas ensures access while maintaining standardized testing conditions.

Candidates appear at examination centers at their own expense and risk. The bank assumes no liability for injuries, losses, or other incidents occurring at examination venues. This standard disclaimer applies across most competitive examinations in India.

Selection Process and Interview Guidelines

The Nainital Bank Recruitment 2025 employs a comprehensive two-stage selection process ensuring candidates possess both technical competencies and personal attributes suitable for banking careers.

Stage 1: Online Written Examination

The computer-based test constitutes the first selection hurdle, with cutoffs applied at two levels—individual test minimums and overall aggregate scores. Candidates must achieve minimum qualifying scores in each subject area while also meeting total score thresholds.

This dual-cutoff approach ensures selected candidates demonstrate well-rounded capabilities rather than excelling in limited areas while showing deficiencies in others. Banking roles require balanced skill sets encompassing quantitative analysis, language proficiency, reasoning abilities, general awareness, and technical knowledge.

Scores undergo equating processes if examinations conduct across multiple sessions with different question papers. According to psychometric principles, equating adjusts for minor difficulty variations across test forms, ensuring fairness regardless of which version candidates receive.

The bank reserves rights to analyze response patterns across candidates, detecting similarities suggesting answer sharing or other misconduct. Candidates found engaging in such practices face disqualification and potential prosecution.

Stage 2: Personal Interview

Candidates clearing written examination cutoffs receive interview calls through emails sent to registered addresses. Interview schedules are typically announced 2-3 weeks before dates, allowing candidates time for preparation and travel arrangements.

Interviews assess candidates’ communication skills, domain knowledge, awareness of banking industry developments, problem-solving approaches, and overall suitability for banking careers. Panel composition typically includes senior bank officers from relevant functional areas, ensuring comprehensive candidate evaluation.

Candidates must carry original documents for verification including educational certificates, experience letters (for Scale-II positions), caste certificates (if claiming reservation), PwD certificates (if applicable), and photo identity proofs matching those provided during application. Document discrepancies lead to candidature rejection regardless of performance in written examination and interview.

Final selection considers combined performance in written examination and interview, with specific weightages determined by the bank. Typically, written examination scores carry 75-85% weightage while interviews contribute 15-25%, though exact ratios vary across positions and recruitment cycles.

Selected candidates receive provisional appointment orders subject to medical fitness certification, document verification, and background checks. The bank conducts pre-employment medical examinations through empaneled hospitals, with appointment confirmed only after satisfactory medical reports.

Bond Requirements and Service Commitments

The Nainital Bank Recruitment 2025 requires selected candidates to execute indemnity bonds guaranteeing minimum service periods before joining. Understanding these obligations helps candidates make informed career decisions.

| Position Category | Bond Amount | Bond Period |

|---|---|---|

| Customer Service Associate | ₹1.5 Lakhs | 2 years |

| Officers (Scale-I & Scale-II) | ₹3.0 Lakhs | 2 years |

Bond amounts represent commitments ensuring candidates serve minimum periods after receiving training investments from the bank. According to employment law principles, such bonds are enforceable provided amounts are reasonable relative to training costs and stipulated periods aren’t excessive.

If candidates resign, terminate employment, or abandon service before completing bond periods, they must reimburse bond amounts plus any additional costs, charges, and expenses incurred by the bank. This includes training expenses, recruitment costs, and administrative overheads.

Two sureties must co-sign bonds, accepting joint liability for bond amounts if primary candidates default. Sureties typically require financial standing demonstration, ensuring they can fulfill obligations if necessary. This requirement follows established practices in government and public sector employment across India.

Candidates should carefully consider bond obligations before accepting offers, ensuring personal circumstances allow completing minimum service commitments. Career planning should account for restricted mobility during bond periods, though transfers within the bank’s network don’t constitute bond violations.

Preparation Strategy for Success

Systematic preparation significantly improves chances in the Nainital Bank Recruitment 2025. Candidates should develop structured study plans addressing each examination component while allocating time proportionate to individual strengths and weaknesses.

Foundation Building (Months 1-2)

Begin with comprehensive coverage of fundamental concepts across all subjects. For Quantitative Aptitude, master basic arithmetic operations, percentages, ratios, averages, and profit-loss calculations before advancing to complex topics. Reasoning requires understanding various question types—puzzles, seating arrangements, coding-decoding, syllogisms—with practice sets for each category.

English Language preparation should emphasize grammar rules, vocabulary building through word lists and reading, and comprehension practice through diverse text types. Computer Knowledge benefits from hands-on experience with software applications alongside theoretical concept learning.

General Awareness demands current affairs tracking from newspapers, business magazines, and banking sector publications. Maintain notebooks documenting important events, policy announcements, and banking developments with monthly review cycles ensuring retention.

According to learning science research, spaced repetition with increasing intervals between reviews optimizes long-term memory formation compared to massed practice.

Practice and Refinement (Months 3-4)

Transition from concept learning to extensive practice through mock tests replicating actual examination conditions. Time management becomes crucial—candidates must answer 200 questions in 145 minutes, averaging approximately 43 seconds per question.

Practice tests reveal time allocation strategies, identifying sections requiring more/less time investment. Some candidates may excel at quick arithmetic but struggle with lengthy comprehension passages, suggesting spending saved time from quantitative sections on careful reading.

Analyze incorrect answers understanding not just right options but also why chosen alternatives were wrong. This diagnostic approach prevents recurring mistakes. According to cognitive psychology principles, analyzing errors strengthens learning more effectively than mere correct answer memorization.

Gradually increase mock test frequency, attempting 2-3 full-length tests weekly in the month preceding examinations. This builds stamina for sustained concentration across 145-minute test durations while familiarizing candidates with computer-based testing interfaces.

Specialist Subject Preparation

Candidates appearing for Specialist Officer positions must thoroughly prepare professional knowledge sections relevant to their domains. IT Officers should review programming languages, database management, networking protocols, and software development methodologies. Risk Officers need comprehensive understanding of Basel accords, risk measurement techniques, and regulatory frameworks.

Chartered Accountants benefit from reviewing accounting standards, auditing procedures, taxation principles, and financial analysis methods. Law Officers must master legal provisions applicable to banking including negotiable instruments, banking regulation, recovery laws, and contract principles.

Credit Officers should focus on credit appraisal techniques, financial statement analysis, working capital assessment, and project financing concepts. Agricultural Field Officers need strong foundations in crop sciences, agricultural economics, rural credit systems, and government agricultural schemes.

HR Officers require knowledge of human resource management principles, organizational behavior concepts, labor laws, performance management systems, and training methodologies.

Professional knowledge sections carry equivalent weightage to general sections (40 marks), making thorough preparation essential. Specialist candidates often underestimate these sections assuming professional backgrounds provide automatic advantages—structured revision ensures comprehensive coverage.

Final Week Strategy

The week before examination should focus on revision rather than new topic learning. Review formula sheets, important shortcuts, and compiled notes. Attempt one final mock test three days before examination, using results to identify last-minute revision priorities.

Avoid intensive studying on the examination eve—light revision coupled with adequate rest ensures optimal mental freshness. According to sleep research, proper rest significantly impacts cognitive performance, memory consolidation, and decision-making abilities.

Prepare examination day requirements including printed admit card, photo identity proof, photocopies thereof, and necessary stationery. Verify examination venue location in advance, planning travel routes accounting for potential delays.

Common Mistakes to Avoid

Learning from others’ errors helps candidates avoid pitfalls that derail even well-prepared aspirants during the Nainital Bank Recruitment 2025 process.

Incomplete Applications: Rushing through application forms causes errors in personal details, educational qualifications, or contact information. Such mistakes create mismatches during document verification, potentially causing disqualification despite clearing examinations and interviews. Carefully verify every entry before final submission.

Poor Quality Document Uploads: Blurred photographs, illegible signatures, or improper thumb impressions lead to application rejection during preliminary screening. Use quality scanners or camera equipment in good lighting conditions. Preview uploaded images before submission, re-uploading if clarity seems questionable.

Payment Issues: Candidates sometimes fail confirming payment completion before closing browser windows or refreshing pages during payment processing. This creates incomplete applications despite fee deduction from accounts. Always wait for payment gateway confirmation messages and download e-receipts immediately.

Last-Minute Applications: Technical difficulties, website traffic, or payment gateway issues often occur during final hours before deadlines. Applying early provides time resolving unexpected problems without missing deadlines. The bank accepts no responsibility for candidates’ inability to submit applications due to internet connectivity or technical issues.

Ignoring Negative Marking: Candidates attempting every question regardless of certainty accumulate substantial negative scores. Strategic skipping of doubtful questions often yields better net scores than answering everything. Calculate thresholds—if confidence level below 50%, skipping typically proves safer than guessing.

Inadequate Time Management: Many candidates spend excessive time on difficult questions early in examinations, leaving insufficient time for easier questions appearing later. Quickly scan entire question papers initially, tackling comfortable questions first before returning to challenging ones with remaining time.

Neglecting Current Affairs: General Awareness sections emphasize recent developments, yet many candidates rely solely on static knowledge. Dedicate 30-45 minutes daily to newspaper reading and weekly current affairs compilations. Banking and economic news receives particular emphasis.

Document Verification Oversights: Selected candidates sometimes lack proper document formats during verification—original certificates without photocopies, outdated caste certificates, or missing no-objection certificates from current employers. Prepare complete document sets immediately after interview calls, avoiding last-minute scrambles.

Career Growth Opportunities at Nainital Bank

Beyond initial recruitment, Nainital Bank offers structured career progression pathways enabling motivated employees to advance through organizational hierarchies while developing professional capabilities.

Customer Service Associates can progress to Senior Customer Service positions and eventually Officer roles through internal promotions and examinations. The bank conducts periodic promotion processes allowing clerical staff demonstrating exceptional performance and passing requisite tests to join officer cadres.

Probationary Officers initially rotate across various departments during probationary periods, typically 18-24 months, gaining exposure to different banking functions. Post-probation, officers receive permanent postings based on organizational requirements and individual preferences where possible.

Career progression for officers follows defined timelines with regular promotions across scales. Scale-I officers typically achieve Scale-II positions within 4-5 years given satisfactory performance. Further advancement to Scale-III, Scale-IV, and eventually Scale-V (senior management) follows as experience accumulates and capabilities demonstrate readiness for greater responsibilities.

According to banking career research, average banking careers span 30-35 years from entry to retirement. Officers joining at ages 23-25 can reasonably expect reaching senior management positions (Scale-IV or above) by their early 40s, spending final 10-15 years in leadership roles shaping institutional direction.

Specialist Officers enjoy similar advancement within specialized domains. IT Officers progress from junior positions to senior management roles overseeing technology functions bank-wide. Risk Officers can rise to Chief Risk Officer positions, while Chartered Accountants may achieve Financial Controller or Chief Financial Officer designations.

Professional development opportunities include sponsorship for certifications like JAIIB (Junior Associate of Indian Institute of Bankers) and CAIIB (Certified Associate of Indian Institute of Bankers), which become mandatory for promotions beyond certain scales. The bank sponsors employees for these examinations, covering fees and providing study materials.

Conclusion

The Nainital Bank Recruitment 2025 represents exceptional opportunities for banking career aspirants across North India. With 175 vacancies spanning diverse positions from Customer Service Associates to specialized managerial roles, the recruitment accommodates various educational backgrounds and career stages.

Competitive salary structures starting from ₹24,050 and reaching ₹93,960, comprehensive benefits including provident fund and gratuity, structured career progression pathways, and the stability of working with an institution backed by Bank of Baroda make these positions highly attractive.

The recruitment process, while competitive, remains transparent and merit-based. Candidates meeting eligibility criteria, preparing systematically across examination subjects, and approaching selection stages strategically significantly improve success probabilities. Understanding application procedures, examination patterns, and interview expectations helps aspirants navigate the process confidently.

Interested candidates should submit applications through the official Nainital Bank website before the January 1, 2026 deadline. Complete recruitment details, including position-specific eligibility criteria and examination syllabus, are available in the official notification PDF.

With banks increasingly embracing digital transformation and expanding service networks, demand for skilled banking professionals continues growing. The Nainital Bank Recruitment 2025 provides entry points into stable, rewarding careers in financial services. Aspirants should seize this opportunity, preparing diligently while maintaining realistic expectations about competition levels.

Remember that successful banking careers require more than just clearing selection processes—they demand ongoing learning, adaptability to technological changes, commitment to customer service excellence, and ethical conduct in all professional dealings. Those bringing these qualities alongside technical competencies will find banking careers at Nainital Bank both professionally fulfilling and financially rewarding.

Key Takeaways

- The Nainital Bank Recruitment 2025 offers 175 total vacancies across Customer Service Associate, Probationary Officer, and Specialist Officer categories

- Online applications are open from December 12, 2025, to January 1, 2026, through the official website www.nainitalbank.bank.in

- Starting salary ranges from ₹24,050 for CSA positions to ₹93,960 for Scale-II Manager positions, with comprehensive benefits

- The online examination is tentatively scheduled for January 18, 2026, with objective-type questions and negative marking

- No prior banking experience is required for Scale-I positions, making this an excellent entry point for fresh graduates

- Educational qualifications vary by position, with minimum requirements starting from graduation with 50% marks

- The selection process includes online written examination followed by personal interview for shortlisted candidates

- Candidates can apply for both CSA and one Officer position separately, with distinct application fees for each

Frequently Asked Questions

Q1: Can I apply for multiple positions in the Nainital Bank Recruitment 2025?

Yes, candidates can apply for both Customer Service Associate and one Officer position. However, you can select only one post within the Officer cadre—either Scale-I (Probationary Officer/Specialist Officer) or Scale-II (Manager positions), not both. Each application requires separate submission with individual application fees. If multiple applications are submitted for the same post, only the latest valid completed application will be retained, and fees paid for duplicate registrations will be forfeited.

Q2: Is previous banking experience required for Nainital Bank Recruitment 2025?

No prior banking experience is necessary for Customer Service Associate or Scale-I Officer positions, making them suitable for fresh graduates meeting educational qualifications. However, Scale-II Manager positions require minimum two years of relevant post-qualification experience in banking or financial institutions. For Manager-Security Officer posts, candidates need minimum five years’ experience as officers in Indian Armed Forces or paramilitary forces at specified ranks.

Q3: What is the negative marking scheme in the Nainital Bank examination?

The examination employs negative marking with 0.25 marks deducted for each incorrect answer across all sections. Since each correct answer carries 1 mark, four wrong answers nullify one correct answer’s benefit. This makes random guessing disadvantageous—candidates should attempt questions only when reasonably confident about answers. Strategic skipping of uncertain questions often yields better net scores than attempting everything with low confidence.

Q4: How do I download the admit card for Nainital Bank Recruitment 2025?

Admit cards become available for download approximately 10-15 days before the examination date through the official Nainital Bank website www.nainitalbank.bank.in. Candidates receive email and SMS notifications when admit cards are ready. To download, visit the recruitment section, click the admit card download link, and log in using your Registration Number/Roll Number and Password/Date of Birth. After downloading, affix a recent recognizable photograph (preferably the same as uploaded during application) on the printed admit card before appearing for examination.

Q5: What documents must I carry to the examination center?

Candidates must bring printed admit cards with affixed photographs, original currently valid photo identity proofs (Aadhaar Card, PAN Card, Passport, Voter ID, Driving License, or Bank Passbook with photograph), and photocopies of the same identity proofs. Ration Cards and Learner’s Driving Licenses are not accepted as valid identity proofs. Without these mandatory documents, candidates will not be permitted to take the examination regardless of their admit card validity. Electronic devices including mobile phones are strictly prohibited in examination halls.

Q6: If I am selected, what is the bond requirement?

Selected candidates must execute indemnity bonds with two sureties before joining. Customer Service Associates sign bonds for ₹1.5 lakhs with a two-year service commitment. Officers in Scale-I and Scale-II execute bonds for ₹3.0 lakhs, also with two-year service requirements. If candidates resign, abandon, or leave service before completing bond periods, they must reimburse bond amounts plus any costs, charges, and expenses incurred by the bank. This includes training expenses and recruitment costs.

Q7: What is the salary for Customer Service Associate positions?

Customer Service Associate positions offer starting basic pay of ₹24,050 in the pay scale 24050-1340/3-28070-1650/3-33020-2000/4-41020-2340/7-57400-4400/1-61800-2680/1-64480. Maximum basic pay reaches ₹64,480 after regular increments. Actual take-home salary will be significantly higher when including Dearness Allowance (typically 35-40% of basic), House Rent Allowance (7-10% depending on posting location), and other allowances including transport, medical reimbursement, and special allowances. Provident Fund contributions and gratuity provide additional long-term financial benefits.

Q8: Can I change my examination center after submitting the application?

No, examination center preferences once exercised during application become final and cannot be modified. However, the bank reserves the right to allot candidates to centers other than their chosen preferences based on administrative feasibility, candidate response volume, or center capacity constraints. The bank may also cancel centers with insufficient registrations or add new centers as needed. Candidates must appear at allotted centers regardless of personal preferences—no requests for center changes will be entertained.

Q9: What happens if there are technical issues during online application submission?

Candidates facing technical difficulties should contact the bank’s recruitment email recruitment@nainitalbank.co.in immediately, providing detailed issue descriptions, screenshots if possible, and registration numbers if already generated. However, candidates bear responsibility for successful application submission—the bank accepts no liability for failures due to internet connectivity, browser compatibility, payment gateway issues, or last-minute rushes. Apply well before deadlines to allow time resolving unexpected technical problems without missing cutoff dates.

Q10: How is the final merit list prepared for Nainital Bank Recruitment 2025?

Final merit lists consider combined performance in online written examinations and personal interviews, with specific weightages determined by the bank for each position category. Typically, written examination scores carry 75-85% weightage while interview performance contributes 15-25%, though exact ratios vary. Candidates must achieve minimum qualifying scores in individual examination sections, overall examination aggregate, and interviews to be considered for final selection. The bank prepares separate merit lists for each position category, with selections made in descending order of total scores until vacancies are filled, subject to medical fitness and document verification.